Home / 2016

Internal Audit

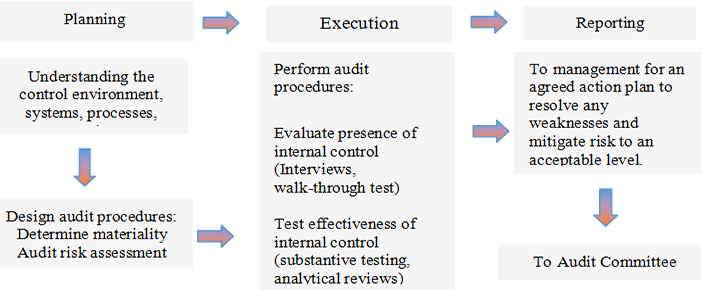

It plays a crucial role in corporate governance, risk assessment and internal control to prevent unpleasant surprises and exploited opportunities.

Other Services

It is our responsibility to carry out financial inspection to your corporate’s account when it comes to auditing. A general understanding on what we do is to verify and review statistic forms as required by the authorities for diligence audit and forensic investigations.

Let us help you to lodge your income tax return! We review all your financial affairs in compliance to tax filing requirements. Additionally, we too provide tax planning and are willing to advise you on tax-related issues such as those matters being discussed by Inland Revenue Board (IRB). Do not underestimate taxation as it has direct influences towards the transfer pricing as well as the tax incentive application.

Our corporate advisory services include liquidation of asset, voluntary liquidations, receivership of a loan, and schemes of arrangement between two parties. The debt restructuring advisor, independent financial advisor and monitoring accountant are dedicated to execute their roles in providing you with the services mentioned above.

We provide seven financial plans which are flexible in its period, whether a short term plan or a long one, tailored to suit your needs. The plans are as listed:

- Risk Insurance Planning

- Investment Planning

- Education Planning

- Retirement Planning

- Estate Planning

- Employee Benefits Planning

- Business Succession

Ways to improve the initial public offering (IPO) are to be advised by our professional consultant. The consultant will also review your cash flow and profit forecast before preparing you an accounting report. To complete the task, a share or business evaluation is to be carried out to assess its performance.

Through public auction, your property is at its highest value. This public auction is applicable to both immovable properties and moveable properties. For those who are less familiar with the types of property, immoveable properties include residential, commercial and industrial properties while moveable properties include machineries and inventories.

We will ensure your company comply with Malaysia Labour law requirements, such as salary calculation, EPF contribution, SOCSO contribution and employee monthly tax deduction. Furthermore, your company payroll information is kept confidential in our office.

We offer a range of services to safeguard your business interests. These services are referring to house counsel advisory, business litigation and dispute management, workers compensation claims management and advisory, general insurance and several others. You can have full trust on us to take charge as we are licensed to provide such services for you.

Internal Audit

Accounting

There are two types of accounting services available:

- Option 1: A full service covering accounting, bookkeeping and finance department.

- Option 2: An outsourced financial controller where monthly and quarterly closings will be performed as your bookkeeping is done in-house.

Monitoring will be conducted from time to time, aiding you in making effective business decisions.

SST Services

SST Impact Study

We review the effects of SST on your daily operation cost and the price of your product or services. Besides, we too study on the ways to efficiently operate your business upon SST implementation, aiding you to educate your employees with knowledge on SST.

SST Implementation

We provide support in transitional issues, assist to deal with impacts resulting from SST implementation, and mapping exercise SST compliant accounting software.

SST Registration

We provide guidance in SST registration, telling you whether should your business register voluntarily for SST or it is compulsory to register when it reaches a threshold.

SST Support and Consultation

We assist you in filling up the SST return form to Royal Malaysian Customs. We ensure all needed particulars are filled to ease the process of refunding SST credit and minimize the chance for any possible error.

SST Advisory and Planning

We provide appropriate advice to ensure that you deal well with the impacts of SST and we also suggest necessary planning before any new business decision is made.